The internet we know today (Web 2.0) is controlled in large part by a handful of companies such as Google, Facebook and Amazon that exchange users’ personal data for goods and services. In Web 2.0, these three companies have ushered in the age of datafication, wherein users’ every interaction on the internet becomes data, giving way to the emergence of Big Data and users’ loss of control over their personal data 1. The internet run on blockchain technology 2 (Web 3.0 or web3) seeks to depart from this dynamic by allowing for databases to run on multiple servers, forcing decentralisation and higher levels of transparency. The adoption of the blockchain may usher in a split in the digital space and a further evolution in datafication.

This decentralization is a key feature of the blockchain, and seeks to build higher degrees of trust in the tools (cryptocurrencies, applications, etc) built on it. Apps can be built for the blockchain, but they must be coded differently to enable them to run on the blockchain because of the distributed nature of the infrastructure. Through these Distributed Applications (Dapps), users can do everything from gaming to joining online communities to buying cryptocurrencies and Non-Fungible Tokens (NFTs). Dapps cannot capture user information and make money from it through advertising, so Dapps and NFT games are important, because they ensure that platforms built on the blockchain can make money in ways that do not rely on surveillance and privacy risk.

The specific affordances of the blockchain, specifically the immutability once a transaction occurs on it, allow ownership of digital assets to be easier to prove. This allows for the possibility of digital assets such as NFTs, and of cryptocurrencies. Cryptocurrencies run on the blockchain, and the immutability of the blockchain means that no coin can ever be used more than once. Units of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated mathematical problems that generate coins. This complex process also insures against fraud. Unlike traditional currencies wherein one can print infinite notes and make an infinite amount of money available to circulate in the economy, cryptocurrencies are capped as a buffer against inflation. Changing funds from cryptocurrency to traditional currency is as easy as withdrawal from cryptoATMs or a transfer from a crypto-wallet 3 to a traditional bank account.

The immutability of the blockchain also affords users improved transparency, and technology innovators have already begun to use it in the creation of various solutions to different problems, including climate governance and transparency on carbon emissions 4. Blockchain technologies are currently being deployed to address climate change related needs. For example, because of the distributed nature of the blockchain and the immutability of it, smart contracts built on the blockchain are accessible to more people and can help enhance transparency in expenditures. Additionally, contract updates can be fully automated following the introduction of new information with updated datasets, allowing such things as crop insurance, carbon emissions, and other green initiatives to be as seamless and transparent as possible. Decentralized energy grids even allow users to sell units of unused electricity from decentralized solar grids 5. None of these solutions are perfect 6, but they do demonstrate potential of the blockchain to bolster transparency.

Although the blockchain could lead to better climate governance and transparency on carbon emissions, the fact that each transaction consumes a considerable amount of energy means that the technology cannot be called ‘light’ in relation to the environment.

“Bitcoin is thought to consume 707 kwH per transaction. In addition, the computers consume additional energy because they generate heat and need to be kept cool. And while it’s impossible to know exactly how much electricity Bitcoin uses because different computers and cooling systems have varying levels of energy efficiency, a University of Cambridge analysis estimated that Bitcoin mining consumes 121.36 terawatt hours a year. This is more than all of Argentina consumes, or more than the consumption of Google, Apple, Facebook and Microsoft combined.”

Renee Cho in “Bitcoin’s Impacts on Climate and the Environment“, State of the Planet. September 2021

However, this dossier recognizes a lighter internet as being not just an environmentally conscious internet, but a more inclusive one as well. This article will explore the extent to which Web 3.0 technologies can contribute to a lighter internet, by evaluating the blockchain along the lines of accessibility, social impact, and climate change.

The adoption of cryptocurrency in developing countries

Cryptocurrencies and, to a lesser extent, NFTs are a major entryway into web3 for many people. As such, cryptocurrencies are an important starting point in any engagement with the blockchain in developing countries.

Cryptocurrencies are widely understood to be decent assets when held in a diversified portfolio including other kinds of assets such as stocks and bonds, but more volatile than G10 country currencies. However, studies done on this topic have not compared the volatility of cryptocurrencies to the volatility of traditional currencies in many developing countries 7. Given the rate of adoption by citizens of developing countries, though, investors outside the G10 countries seem to think cryptocurrencies are a worthwhile investment and hedge them against their even more volatile traditional currencies. The tendency to see cryptocurrency as a valuable hedge against tough economic times showed itself during the pandemic, when the value of Bitcoin reached nearly 20,000 USD by the end of 2017, dropping down to less than 5,000 USD in the last quarter of 2018, while recuperating its value again in 2020 and reaching new record highs in 2021 in the midst of the COVID-19 pandemic 8.

For people for whom the volatility of their local economies is a more protracted problem, cryptocurrencies like Bitcoin and Ethereum can be a lifeline. When hyperinflation and U.S. economic sanctions hampered Venezuela’s economy, cryptocurrencies’ popularity soared. The country became the tenth highest adopter of Bitcoin, and 10 of the country’s top 50 websites were cryptocurrency related, including popular NFT games like Axie Infinity 9. Inflation is also a key reason for cryptocurrency adoption in countries like Nigeria, Tanzania, and Zimbabwe 10. Through adoption of cryptocurrencies, these countries are able to hedge their bets against the volatility of their immediate environment.

This does not mean, however, that cryptocurrencies hold no danger for regulators and users alike.

Cryptocurrencies and access

Different countries have responded to cryptocurrency emergence in different ways. In Nigeria, for example, the Central Bank has been progressively harsher 11 since its first policy memo on cryptocurrencies was issued in 2017, citing its volatility as a main issue.

“While the new directive doesn’t explicitly void the legality of virtual currencies, it goes a step further than the 2017 guidance, by making trading them in Nigeria basically impossible. While the 2017 note prohibited banks from doing crypto deals, it did allow them to have exchanges as customers, provided they met certain requirements. Language in the latest guidance appears to make dealing on any exchanges illegal.”

Ademola Bakare in “Cryptocurrency Trading: CBN Orders Banks To Close Operating Accounts“, 2021.

The Nigerian government’s stance on crypto, however, has not deterred Nigerians from using the digital asset. The country saw cryptocurrency transactions worth more than $400 million generated in 2020, with the country ranking third on the planet in terms of highest Bitcoin trading volume and a year-on-year increase on that figure by June 2021 12.

By contrast, the Venezuelan government under their President Maduro had no choice but to welcome cryptocurrencies for the good of the local economy. U.S. economic sanctions contributed to a deteriorating economic situation that led to hyperinflation, and the population needed workarounds to ensure they could secure their investments and still be able to make purchases. As the popularity of Bitcoin and other cryptocurrencies grew, there emerged the need to create policy. For instance, the lack of clarity on cryptocurrency policy provided law enforcement with the perfect opportunity for corruption and abuse. In order to address this, Maduro’s administration created regulations and guidelines for legal mining of cryptocurrencies in Venezuela. It also commenced minting its own national coin called Petro, 82.4 percent of which will be in circulation with the remainder in the national reserve 13. However, the Petro represents more economic freedom only for some. The availability of the Petro has also made it easier for wealthy Venezuelans to send their money abroad 14, giving them an even safer way to preserve their investments and ensuring that the problem of economic inequality under the previous financial regime continues to persist.

Platform labor in the blockchain

The main issue that governments have been concerned about so far with regards to cryptocurrency has been its volatility and what it means for the value of investors’ assets, but there is evidence that digital assets require fastidiousness in other areas. In places with high levels of youth unemployment or income inequality, the blockchain can still be an arena wherein people can be exposed to exploitation.

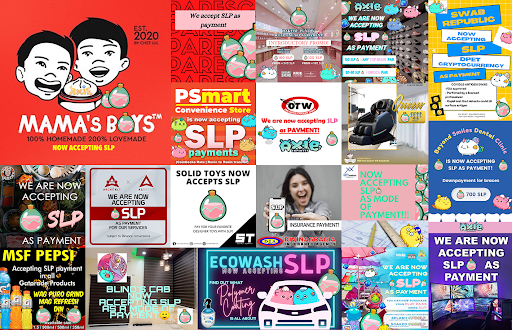

The example of Axie Infinity in the Philippines illustrates how platform labour could change form in the blockchain. With 660,000 active users, Axie Infinity is one of the most popular NFT Dapps. It was developed by Vietnamese studio Sky Mavis in 2018 and is now valued at 3 billion USD. In this game, players buy Axie characters to play the game, and can earn money training and fighting the Axie versions of Pokemon characters. Interestingly, 40 percent of Axie players are reportedly based in the Philippines 15. The developer says 25 percent of its players have never had a bank account before 16, so their Axie wallets are the first financial services they’ve ever been able to access (Naavik, 2021). In some places in the Philippines, people are paying their rent with the game’s Smooth Love Potion (SLP) token. That helps explain how Axie’s total trading volume now exceeds 2.4 billion USD 17.

Axie Infinity has transcended virtual reality and has tangible implications on income earning and access to finance for users in the Philippines. To play Axie Infinity, a user must have at least three Axies, which in total cost about 1,000 USD; a cost that is too steep for young unemployed people. Guilds have sprung up to provide ‘scholarships’ to enable intending players to play the game. Through these ‘scholarships’, guilds buy Axies, rent them to incoming players, and get a cut of the earnings the players make from the game 18. This dynamic allows the lender to continuously make profit off of the player, as long as they are using Axies purchased from the guild. This creates an opportunity for exploitation of players with less money that need financial support to access the game.

Conclusion: blockchain and a lighter internet

The decentralization of the blockchain was created to address systemic challenges that have been the bane of web 2.0, and answers privacy and tracking concerns by creating new modes of datafication and, by extension, monetization. NFTs and cryptocurrencies are key to the monetization that makes web3 viable, and as NFT games become increasingly popular and digital assets become more mainstream, governments the world over will need to reckon with what it means for policy for there to be digital assets that exist solely online.

Blockchain is also promising in terms of accessibility, given that cryptocurrencies built on it allow citizens of countries anywhere, including those that are facing economic sanctions, an opportunity to still access the global financial system. However, the long-term sustainability of blockchain will depend on its environmental impact while creating systems that limit the conditions for inequality and abuse – something that is also the bane of Web 2.0. This includes having an expanded understanding of what platform labor entails, and what regulations are possible to forestall possible incidents of abuse.

In the creation of a new system, it is important to learn lessons from, and improve upon, what came before. Blockchain can lead to a lighter internet, but it will not get there without an active effort. A lighter blockchain-based internet will be the result of policy that reduces safeguards against exploitation, is environmentally sustainable and contributes meaningfully towards the kind of world that models possibilities for all people.

References

| ↥1 | Goriunova, O. (2019). The Digital Subject: People as Data as Persons. Theory, Culture & Society, 36(6), 125–145. |

| ↥2 | Blockchain is a distributed database that is not centered on any one server. Instead, data is tabulated in a database then stored in blocks similar to cells in a spreadsheet, and once a block is filled the data is then moved to a different block, thereby forming a chain. Because data is distributed, it helps ensure the fidelity of the data across the various servers on which the data is contained |

| ↥3 | A platform where you can securely keep your cryptocurrency or NFTs |

| ↥4 | UNFCCC. (2021, May 17). The Good, The Bad And The Blockchain. Innovative Approaches and Tools. |

| ↥5 | UNEP. (2022). Blockchain for Sustainable Energy and Climate in the Global South: Use Cases and Opportunities (Blockchain for Sustainable Energy and Climate in the Global South, p. 58). United National Environment Program. |

| ↥6 | Khan, S. N., Loukil, F., Ghedira-Guegan, C., Benkhelifa, E., & Bani-Hani, A. (2021). Blockchain smart contracts: Applications, challenges, and future trends. Peer-to-Peer Networking and Applications, 14(5), 2901–2925. |

| ↥7 | Letho, L., Chelwa, G., & Alhassan, A. L. (2022). Cryptocurrencies and portfolio diversification in an emerging market. China Finance Review International, 12(1), 20–50. |

| ↥8 | Huang, Y., Duan, K., & Mishra, T. (2021). Is Bitcoin really more than a diversifier? A pre- and post-COVID-19 analysis. Finance Research Letters, 43, 102016. |

| ↥9 | Abad, J. (2022, February 12). P2P payments spurred crypto adoption across Venezuela in 2021. Cointelegraph. |

| ↥10 | Oluwole, V. (2021, August 13). Nigeria is the leading country per capita for Bitcoin and cryptocurrency adoption in the world—Report. Business Insider Africa. |

| ↥11 | Handagama, S. (2021, February 7). Nigerian Central Bank Says Its Ban on Crypto Accounts Is Nothing New. |

| ↥12 | Ndujihe, C. (2021, November 30). CRYPTOCURRENCY: Investigate rising adoption despite restrictions, Expert urge Senate. Vanguard News. |

| ↥13 | Lujan, R. E. (2018). Venezuela issues general legal framework on cryptoassets and the “petro” cryptocurrency. Norton Rose Fulbright, Legal Update, 3. |

| ↥14 | Martin, N. (2021, April 16). Venezuelans try to beat hyperinflation with cryptocurrency revolution | DW | 16.04.2021. DW.COM. |

| ↥15, ↥17 | https://naavik.co/business-breakdowns/axie-infinity/#axie-decon= |

| ↥16 | Villanueva, J. (2021, September 16). Goal to have 70% of adult Filipinos with bank accounts doable. Philippine News Agency. |

| ↥18 | Timmerman, A., & Elliot, V. (2022, February 23). NFT gamers search for the next big thing as players abandon Axie Infinity. Rest of World. |